Opportunities exist in the marketplace for investors to diversify their real estate holdings while deferring capital gains of highly appreciated and long-held assets. Real estate property owners may find utilizing a combination of Section 1031 Exchange and Section 721 Exchange, also referred to as a "Two-Step UPREIT Transaction", to be a beneficial tax mitigation process. Knowing that each investor's specific situation is different, we recommend that the investor seek the advice of tax and legal professionals to understand risks and how this can apply to their unique situation.

Rather than a 1031 like kind exchange, a 721 Transaction allows an investor to contribute property directly to a Real Estate Investment Trust (REIT) operating partnership (the entity through which the REIT acquires and owns its real estate) in exchange for operating partnership units (OP Units). A 721 Transaction may be helpful for property owners with significant gains where a sale would incur a tax liability or those looking for estate planning tools to pass wealth on to heirs in a tax-efficient manner. The most recent year brought concerns around the future of Section 1031, and the 721 Transaction may be an option to diversify away from these uncertainties.

Section 721 of the Internal Revenue Code permits owners of real estate properties to contribute their assets, on a tax-deferred basis, to a partnership in exchange for interest or operating units in the partnership. REITs often hold their real estate portfolio through an operating partnership known as an Umbrella Partnership Real Estate Investment Trust, or UPREIT. The UPREIT structure allows real estate holders to exchange their property for OP Units of the operating partnership by contributing that property through a 721 Transaction. The OP Units have a similar structure to the shares of the REIT and, after a predetermined time, can generally be converted to actual shares of the REIT for additional liquidity. This conversion from OP Units to shares would trigger a tax liability.

Many real estate investors use the 721 Transaction to complement or as an alternative to Section 1031 Exchange. Real estate owners looking to invest in a more extensive portfolio with diversification, professional management, economies of scale, increased liquidity, and added estate planning benefits may find the REIT an attractive tool. The 721 Transaction can provide many benefits while deferring potential tax liability on their original property.

To execute a 721 Transaction investment property is contributed to the operating partnership of a REIT. Depending on the type of property the individual is contributing, it may be challenging to find a REIT willing to execute the UPREIT transaction. One may find it difficult to UPREIT a small apartment building, condo, or single-family home, as an example.

Many full-service real estate advisory firms, or sponsors, create investment programs to accommodate market demand for passive real estate 1031 exchange products. These programs, subject to the Securities Act of 1933 and investor suitability requirements, are often structured as Delaware Statutory Trusts (DSTs). Purchasing DST interests provide investors with a vehicle to exchange proceeds from a real property sale into professionally managed, institutional quality real estate through the Section 1031 Exchange process.

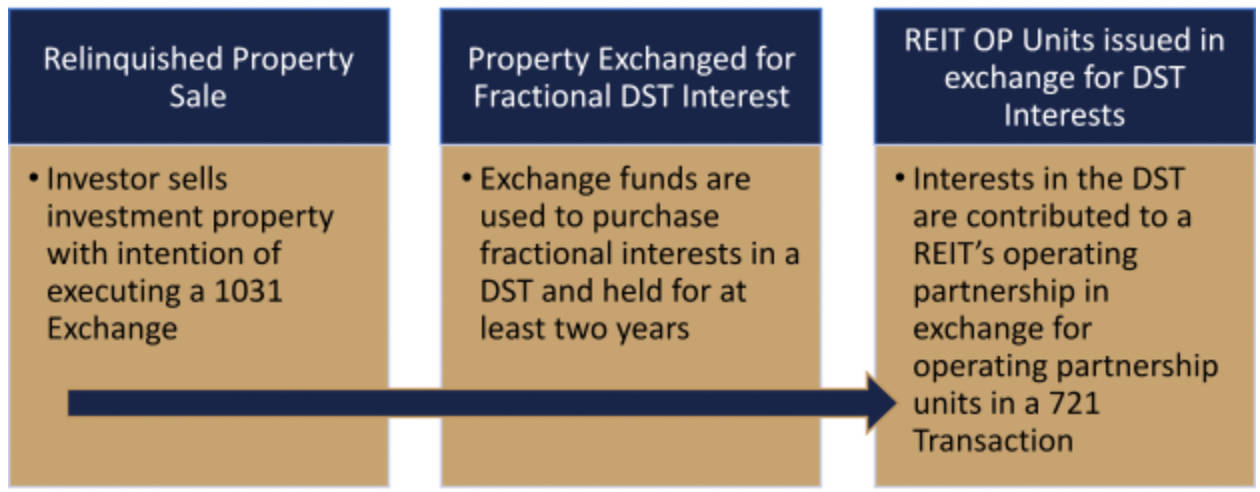

Many investors do not hold real estate attractive to a typical REIT for the UPREIT Transaction. Using the DST, an accredited investor sells tangible property to a third party and uses the proceeds from the sale to purchase a fractional interest in a DST. Following the 1031 guidelines, the investor would purchase interest equal to or greater than in the DST, potentially deferring any tax liability that may have been due.

The REIT can then acquire the DST asset through the UPREIT transaction. The operating partnership of the REIT is receiving all the DST interests from the beneficial owners in exchange for OP Units. By exchanging into a DST, an individual can access typical institutional assets attractive to a REIT.

Sometimes, these sponsors will create custom programs, where other registered entities they manage invest in the DST with a future option to purchase the investor ownership position. For example, imagine that an investment program sponsor creates both a publicly registered non-traded REIT and a DST program focused on the same type of asset. The REIT takes a percentage ownership position in the DST with the investor doing a 1031 exchange into the remaining position or mutually agreed to minority share. The REIT then has an option to purchase the investor interest in the future through the 721 UPREIT. A typical DST 721 Transaction should generally occur no less than two years after the beneficial owners acquire the DST interest. An agreement with a REIT, additionally, does not constitute a guarantee the REIT will execute the UPREIT transaction.

Further, should the REIT exercise its option to purchase the investor position in the DST, the investor may choose to accept OP units in the REIT through a Section 721 Exchange or as cash proceeds from the sale. Should the investor take the cash option, they can do another Section 1031 Exchange or keep the proceeds and pay taxes. Should the investor accept the OP Units in the REIT through the 721 Exchange, the investor may achieve greater diversification by owning the REIT.

Diversification

Many investors incur concentration risk by owning one property in a single market. REITs tend to own many assets diversified through different markets. The 721 Transaction into a REIT can give the ability to diversify an individual's portfolio, which may reduce concentration risk. A REIT can provide similar benefits of real estate ownership such as appreciation, tax shelter through depreciation, and income.

Investors typically will receive income generated by the DST before a DST 721 Transaction and from OP Units of the REIT through distributions. Income generated by the DST or Op Units may have tax advantages due to depreciation and other strategies.

LiquidityThe ability to convert OP Units of the REIT to shares can provide liquidity benefits that are not standard with DST or property ownership. Partial or full liquidity may be achieved, depending on availability determined by the company, by converting the OP Units to shares of the REIT. While this is a taxable event, it gives more control to spread tax liability or access capital.

Estate PlanningA common estate plan is to pass real estate wealth on to the next generations. The 721 Transaction can be beneficial due to the increased liquidity provisions. There is often conflict on the division and timing of inherited assets within families and DST or real estate ownership can be restrictive on liquidity. On the other hand, ownership of OP Units converted to shares can split up how desired by the estate and can be passed to heirs at a step-up in basis, eliminating the potential tax liability due by the original owner upon passing.

Future Change to 1031 Tax CodeIt is not unusual to see tax code overhauls with administration changes. The 2017 Tax Cuts and Jobs Act eliminated 1031 exchange for all assets besides real estate, and in the past year, legislative proposals have been made to further limit eligibility for 1031 exchanges. Proposed changes to Section 1031 are nothing new and will likely continue in the future. The 721 Transaction may be an attractive alternative to investors concerned about the prospect of restrictions on 1031 exchanges.

This is for informational purposes only, does not constitute as individual investment advice, and should not be relied upon as tax or legal advice nor does this informational material does not constitute an offer to purchase or sell securitized real estate investments. Please consult the appropriate professional regarding your individual circumstance. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax concepts, therefore you should consult your legal or tax professional regarding the specifics of your particular situation. Because investor situations and objectives vary this information is not intended to indicate suitability for any individual investor. There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Securities offered through Concorde Investment Services, LLC (CIS). Member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC (CAM), an SEC registered investment advisor. Sequent Real Estate and Wealth Management is independent of CIS and CAM